All Categories

Featured

Table of Contents

Capitalist with a special lawful standing An approved or sophisticated financier is an capitalist with an unique condition under financial regulation laws. The meaning of a recognized investor (if any), and the repercussions of being categorized as such, range countries - accredited investor llc requirements. Usually, accredited capitalists consist of high-net-worth people, banks, banks, and other large corporations, who have access to complex and higher-risk investments such as financial backing, hedge funds, and angel investments.

It specifies sophisticated financiers to ensure that they can be dealt with as wholesale (as opposed to retail) clients. According to ASIC, an individual with an innovative capitalist certification is an innovative capitalist for the purpose of Chapter 6D, and a wholesale client for the function of Phase 7. On December 17, 2014, CVM provided the Instructions No.

A company integrated abroad whose tasks resemble those of the firms laid out above (crowdfunding accredited investors). s 5 of the Stocks Act (1978) defines an innovative financier in New Zealand for the objectives of subsection (2CC)(a), a person is rich if an independent chartered accounting professional certifies, no more than year prior to the offer is made, that the chartered accounting professional is pleased on reasonable premises that the individual (a) has web assets of a minimum of $2,000,000; or (b) had an annual gross earnings of at least $200,000 for each of the last 2 monetary years

"Spousal matching" to the accredited capitalist interpretation, so that spousal matchings might merge their funds for the function of qualifying as accredited investors. Obtained 2015-02-28."The New CVM Directions (Nos.

Accredited Investments

Recovered 2018-08-13. "Practical Law CA (New Platform) Signon". Recovered 2021-01-20. Health, Jason (7 December 2015). "Soon you will have the ability to invest like the really abundant, with all the benefits and dangers". Financial Article. "EUR-Lex 32004L0039 EN". Official Journal L 145, 30/04/2004 P. 0001 0044. Kriman, Refael. ""Accredited Investor" New Modification - Securities - Israel".

"Modifications to the "Accredited Investor" program in Singapore Lexology". www.lexology.com. Retrieved 2021-01-20. "SEC.gov SEC Updates the Accredited Investor Interpretation". www.sec.gov. "SEC.gov Accredited Investors". www.sec.gov. 17 C.F (sec certification requirements).R. sec. 230.501(a). This article incorporates message from this resource, which remains in the public domain. "SEC.gov Often asked concerns about exempt offerings". www.sec.gov. This post includes message from this source, which is in the public domain

"What Is An Accredited Capitalist?". BAM Capital. Fetched 7 February 2023. Hube, Karen (19 September 2023). "More Investors Might Get Accessibility to Private Markets. Some Are Raising a Warning". Barron's. Iacurci, Greg (19 December 2023). "Rising cost of living gives millions new access to investments for the rich, says SEC". CNBC.

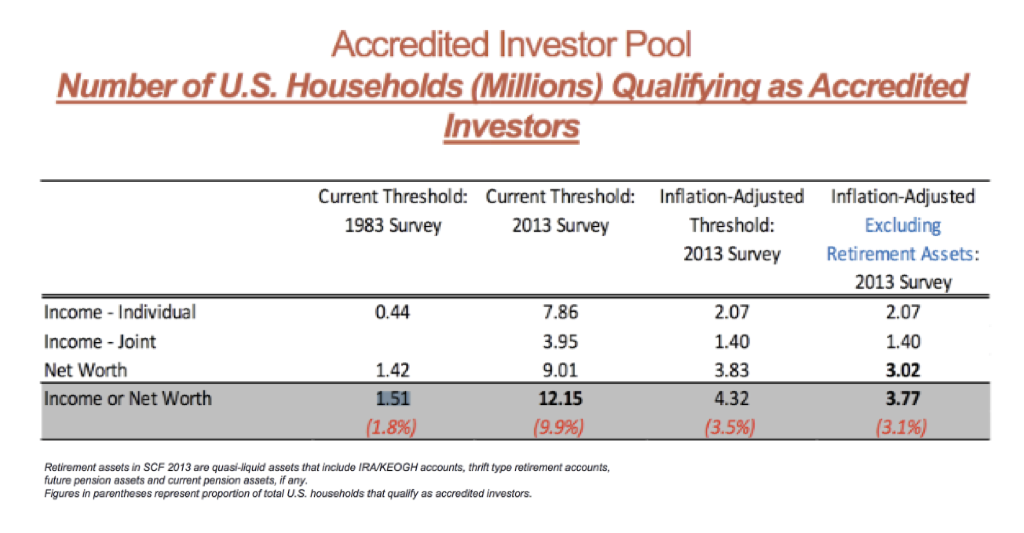

Accredited capitalists include high-net-worth people, financial institutions, insurance provider, brokers, and trusts. Accredited investors are specified by the SEC as qualified to buy facility or sophisticated types of safety and securities that are not closely controlled - non accredited investor. Particular standards must be fulfilled, such as having an ordinary yearly income over $200,000 ($300,000 with a partner or cohabitant) or working in the economic industry

Non listed safety and securities are naturally riskier due to the fact that they do not have the typical disclosure demands that feature SEC registration. Investopedia/ Katie Kerpel Accredited investors have blessed accessibility to pre-IPO business, financial backing firms, hedge funds, angel investments, and different offers involving facility and higher-risk financial investments and tools. A firm that is looking for to raise a round of funding may determine to directly approach certified financiers.

Such a business could determine to use safety and securities to recognized investors directly. For approved investors, there is a high possibility for risk or incentive.

Accredited Investor 401k

The guidelines for certified capitalists vary amongst territories. In the U.S, the meaning of a recognized capitalist is put forth by the SEC in Rule 501 of Guideline D. To be a certified investor, an individual should have an annual income surpassing $200,000 ($300,000 for joint income) for the last 2 years with the expectation of earning the same or a greater income in the current year.

This quantity can not consist of a main residence., executive police officers, or supervisors of a business that is releasing unregistered safeties.

Investment Opportunities For Accredited Investors

If an entity is composed of equity proprietors that are approved investors, the entity itself is an accredited capitalist. Nevertheless, a company can not be formed with the single function of purchasing particular safeties. An individual can certify as an accredited investor by demonstrating adequate education and learning or task experience in the economic sector.

People that want to be approved investors do not relate to the SEC for the designation. real estate investments for accredited investors. Rather, it is the obligation of the firm providing an exclusive placement to ensure that all of those approached are approved investors. People or parties who desire to be recognized investors can approach the company of the non listed safety and securities

Non-accredited Investor

Suppose there is a specific whose earnings was $150,000 for the last 3 years. They reported a key house value of $1 million (with a home loan of $200,000), a cars and truck worth $100,000 (with a superior funding of $50,000), a 401(k) account with $500,000, and a cost savings account with $450,000.

Net well worth is computed as assets minus liabilities. This individual's total assets is specifically $1 million. This involves a calculation of their assets (aside from their main home) of $1,050,000 ($100,000 + $500,000 + $450,000) less an automobile financing equaling $50,000. Given that they satisfy the internet well worth need, they qualify to be an accredited investor.

There are a few much less typical certifications, such as taking care of a trust fund with even more than $5 million in possessions. Under federal safeties regulations, only those who are accredited investors may join particular securities offerings. These may consist of shares in private placements, structured products, and private equity or hedge funds, to name a few.

Table of Contents

Latest Posts

Sales In Excess

Tax Default Homes

Tax Foreclosure

More

Latest Posts

Sales In Excess

Tax Default Homes

Tax Foreclosure